Banks need to adjust to the COVID-19 reality

The upcoming COVID-19 recession, that will likely be deeper than the global financial crisis of 2008, is already heavily impacting significant a share of households, SMEs and corporates.

Banks need to proactively prepare for the new reality. The portfolio needs to be reviewed and addressed with short term as well as long term saving measures. Short term saving measures such as payment moratoria endorsed by the European Banking Authority (EBA) and local governments will likely help healthy borrowers to overcome liquidity issues related to the COVID-19 crisis. However, for the endangered segments of customers, further long-term solutions such as loan modification or forbearance programs needs to be introduced.

Moratoria programs, EBA Response and Loan Modification

To mitigate immediate negative short term COVID-19 effects on liquidity of borrowers, the governments across the world are introducing legislative moratoria providing payment holidays usually for 3 to 9 months.

The EBA reacted with guidelines on legislative and non-legislative moratoria on loan repayments applied in light of the COVID-19 crisis. The main aim of the guidelines is to clearly define that the moratoria as defined in the guidelines do not trigger forbearance classification with all its effects to provisioning.

However, the EBA guidelines also note that banks are expected to prioritize risk assessment of borrowers where it is most likely that the short-term shock may transform into long-term financial difficulties and eventually lead to insolvency. Such borrowers must be treated with caution and forbearance classification could potentially apply.

Loan Modification Program

The proactive offer of long-term solutions such as loan modification to potentially endangered segments of borrowers thus should be, besides moratoria, another main pillar of the bank response to the ongoing COVID-19 crisis. Launch of preventive loan modification program will help you to reduce the inflow of new cases into collections as well as decrease the need for loan loss provisions associated with forbearance programs that those clients would likely have to go through if treated re-actively.

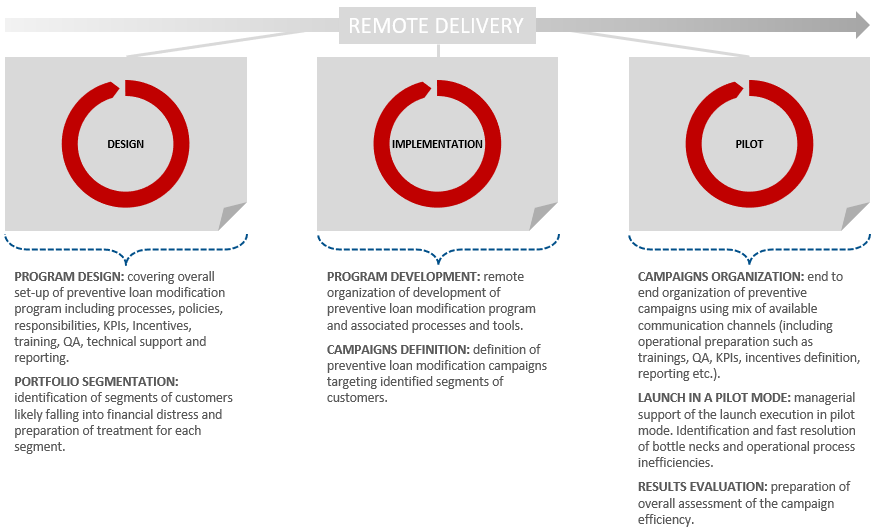

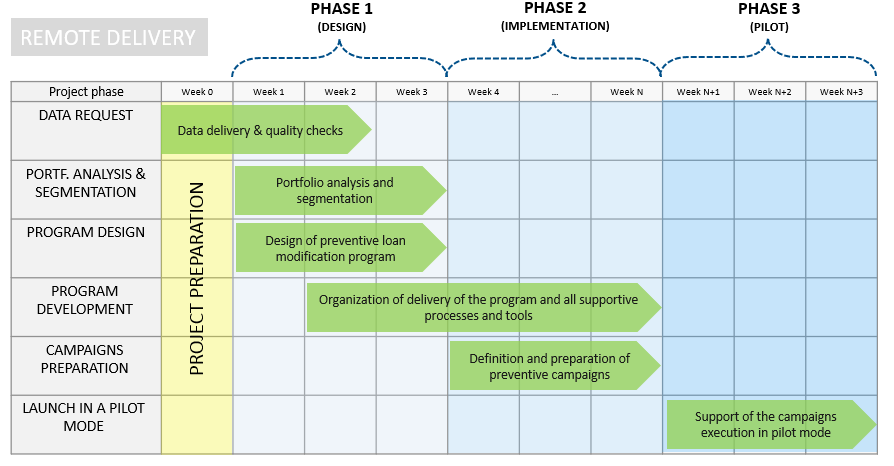

Remote project delivery with an experienced partner is the best option

COVID-19 spreading around the globe limits the possibility of on-site project delivery. We believe that a remote project with an experienced partner, such as Adastra Business Consulting is the best way to go.

Why choose Adastra Business Consulting?

ABC has extensive experience with collections and a track record of 120+ successfully delivered projects in the area. We have also helped many large banking groups such as Unicredit, Raiffeisen, Societe Generale, Sberbank, OTP and others to address collection issues (PI, SME and Corporates) resulting from the financial crisis of 2008.