During exceptional times like these, cash flow is likely to be difficult to manage. Cash flow planning will provide a clearer picture of where your company is headed as well as visibility into where improvements or adjustments need to be made.

Be ready to act

Taking swift actions to manage potential cash flow issues can help your organization prevent running out of cash and stay solvent, even in the absence of additional financing.

The crisis cash flow planning will help you to forecast more accurate cash positions, minimize expenses & overheads, and manage your working capital to improve liquidity.

We deliver first results in as short as 4 weeks and work with your existing planning tool or tool from one of our technology partners:

Our Quick Response

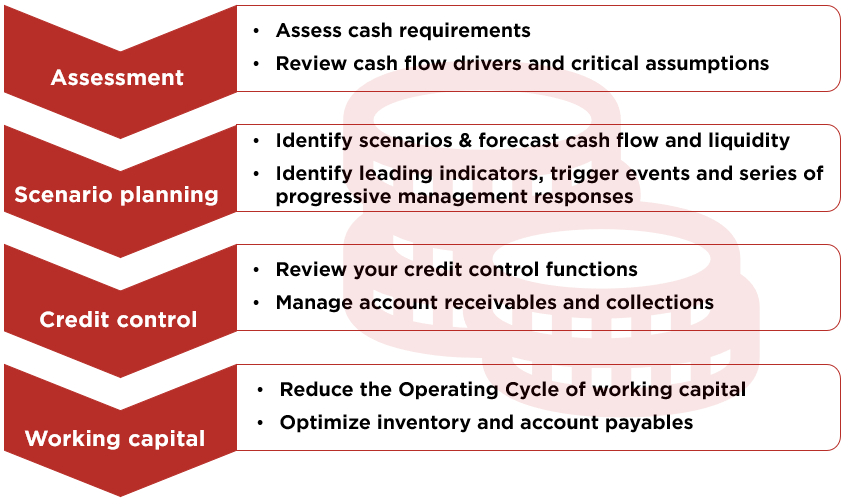

Our detailed assessment will pinpoint the critical areas of your cash flow forecasts, drivers, credit control function, operating cycle of working capital, and receivables collections. We will help you design a dynamic cash flow plan, which can be easily updated and support iterative scenario analysis.

Where we can help your organization:

- Assess current cash positions and perform crisis scenario analysis

- Create more accurate cash flow forecasts

- Improve your cash conversion cycle

Why choose Adastra

Adastra Group combines deep business expertise and remarkable IT capabilities. We are your one stop shop partner for conversion of your existing planning process into a modern efficient and automated process tailored to your needs, providing your business maximal competitive advantage.

We are an experienced partner with 10+ years of hand on experience with driving of planning, forecasting and budgeting processes from business and IT perspective across industries, including continuous projects for large automotive and companies.