Fraud can come in many shapes and forms and are present across industries, including Banking, Telco, Insurance, Retail or Gaming. As services are continuouly shifting towards fully online customer journeys, new fraud schemes are emerging and exploiting weaknesses of digital processes.

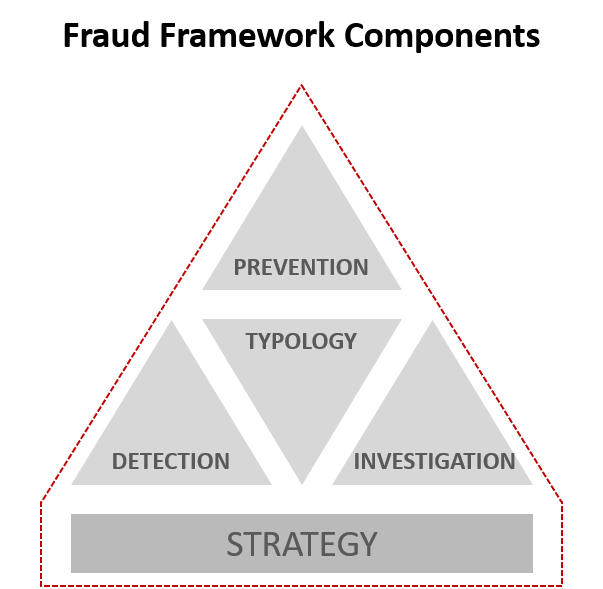

To limit financial and reputational losses associated with fraudulent behavior, we help organizations to build comprehensive fraud frameworks, a set of policies, processes and reports focusing on deterring potential fraudsters, preventing fraud attempts, detecting fraudulent acts, investigating them and incorporating outcomes of investigations back into fraud policies.

Our Approach

We help our clients to set-up resilient, end to end fraud frameworks with clearly defined strategies, appropriate technology stack and supportive organizational set-ups. Below are the main fraud management areas we focus on:

Fraud Typology

Understanding the fraud you might be facing, learn from history and understand weak points of your processes.

Prevention

Set-up fraud preventive measures tailored to processes in your organization and mitigate risks of fraud realization.

Detection

Set-up detection mechanisms, early warning signals, reporting and organization culture to timely detect ongoing fraud.

Investigation

Investigate every fraud case in detail to better understand what happened and also to prosecute the perpetrators.

Our Services

Enterprise Fraud Health Check

Independent evaluation and benchmark of fraud management processes with improvement recommendations.

Fraud Framework optimization or set-up

Set-up or re-design of selected fraud management processes in order to decrease observed level of fraud.

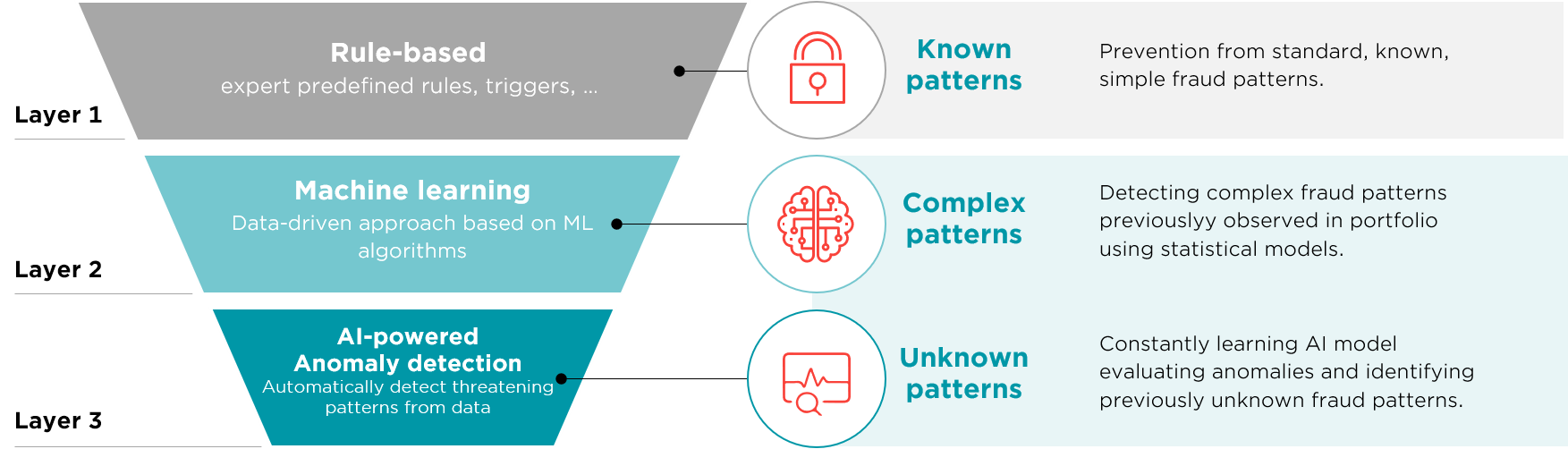

Fraud scoring & anomaly detection

Preparation of statistical model identifying high risk customers and incorporation of the model into company processes.

Online Products Fraud Prevention

We set-up fraud prevention measures specifically for fully online customer journeys and online products.

Further AI Technology for Fraud Detection

1. AI powered anomaly detection automatically detecting new types of abnormal applications, claims, circumstances and potential fraud.

2. AI powered investigation of relationships allowing identification of relationships, clusters and chains of connections between all entities of the company operations (clients, employees, partners, devices etc.).

3. Computer Vision and Natural Language Processing using extracted unstructured text or information from images or videos provided by clients, employees or 3rd parties (e.g. satellite imaginary) to detect ongoing fraudulent behaviour or quantify loss.