EU Bank Recovery and Resolution Directive – BRRD (2014/59/EU, as amended) requires banks to prepare recovery plans to overcome potential financial distress and to update existing plans at least annually or after a change to banks’ business or its financial situation. BRRD set number of factors, indicators and measurements (capital, liquidity, profitability, operational and other) which need to be (re)considered. Based on recovery plans banks may need to renegotiate tools and financial instruments they are using, which can impact costs of funding and compliance costs.

While compliance with the regulatory requirements is a mandatory exercise for all the regulated institutions, it is actually very important for the banks to have recovery plans written in a really practical manner and have it tested on scenarios relevant to the banks’ business.

KEY FOCUS POINTS OF THE SUPERVISORY AUTHORITIES

- Increase usability of plans in crisis situations

- Ensure that banks can react to fast moving liquidity events / cyber scenarios

- Achieve a more realistic view on institutions overall recovery capacity i.e. their resilience in crisis situations

- Integration of the recovery plan into governance framework

- Arrangements to prevent impact on bank’s clients

KEY ELEMENTS OF THE RECOVERY PLAN

Governance (bank’s board/seniors)

Documentation and data (recovery plan should be supported by documentation, data and management information)

Integration (with the bank strategic planning, processing, risk management, capital, liquidity and finding planning, etc.)

Scope (the whole banking group, and any entity within the group that performs a critical function)

Critical functions and business lines

Scenarios (firm‑specific, market‑wide and systemic scenarios, and combinations of them)

Triggers (ratings downgrades, sustained decrease in profitability, decrease in liquidity coverage ratio (LCR), etc.)

Recovery options (measures)

Updating of the impact and feasibility analysis of recovery options

Tasks, responsibilities and decision competences

Our Services

Bank recovery plan preparation

Putting the puzzle together in a highly structured and pragmatic way.

Integration of the recovery plan

Linking recovery plan with governance and risk management procedures.

Recovery options identification.

Finding and describing recovery option for relevant scenarios.

Review of underlying documentation

Completeness review of relevant bank’s policies and procedures.

Setting up indicators and triggers

Identification and calibration of recovery indicators and triggers.

Update of existing recovery plans

Reflection of actual internal and external environment.

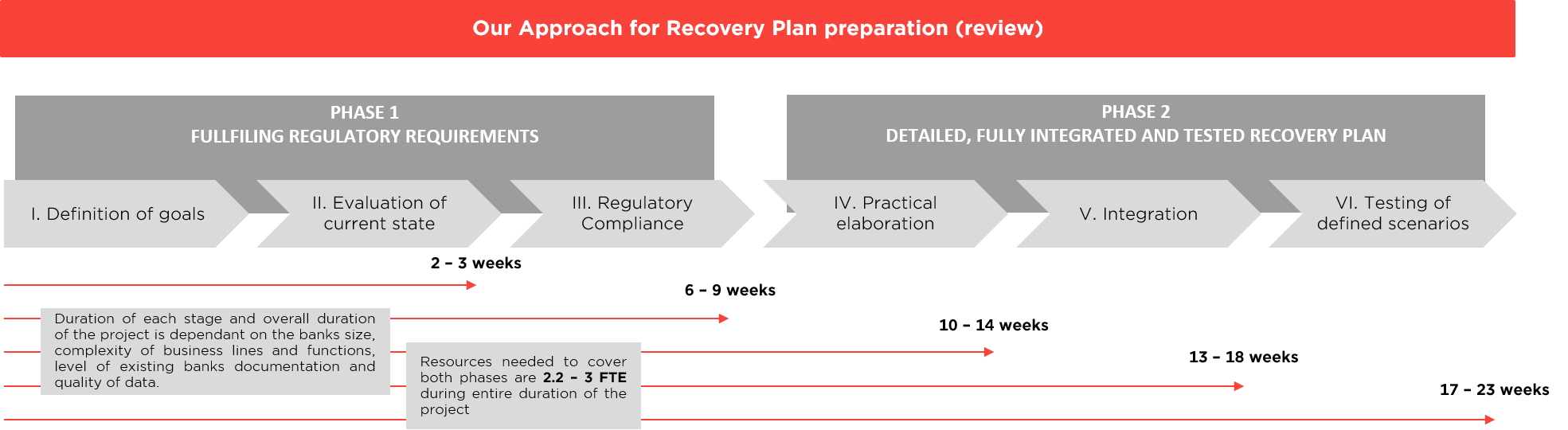

Our Approach