Don’t force your clients to visit a branch when they want to sign-up for your business. Our digital onboarding solution will help your organization to digitize end to end onboarding processes in a secure and scalable way in as fast as 10 weeks. Let your customers onboard your services online within 5 minutes.

Handling a client’s request via the onboarding app takes 5 minutes on average.

Our Solutions

We help organizations to create secure, high converting, user friendly digital customer onboarding. Our services covers the following 3 areas:

Set-up Digital Onboarding

Design, test and deploy digital onboarding solutions tailored to your needs.

Verification and Approval Process

Authenticate customers using eKYC toolkit and deploy automated credit risk evaluation processes.

Optimize Conversion

Analyze your conversion, optimize user journey, organize the follow-up and create valuable customers.

The Adastra Digital Onboarding platform has a complete library of 80+ responsive UI elements you can style & use right away. Each component has been battle tested and optimized data collection & processing needs.

Average time to build a change request

Monitor absolutely everything. With Adastra digital onboarding you will not stay in the dark when it comes to measuring performance. We record every event that occurs between your customer or sales agent and your application.

Use our standard or tailored made AI powered eKYC features consisting of ID card OCR, customer liveness detection and comparison of customer photo taken during onboarding to ID card photos or other available customer photo from internal/external databases. We also provide fraud score calculation enhancing reliable customer authentication.

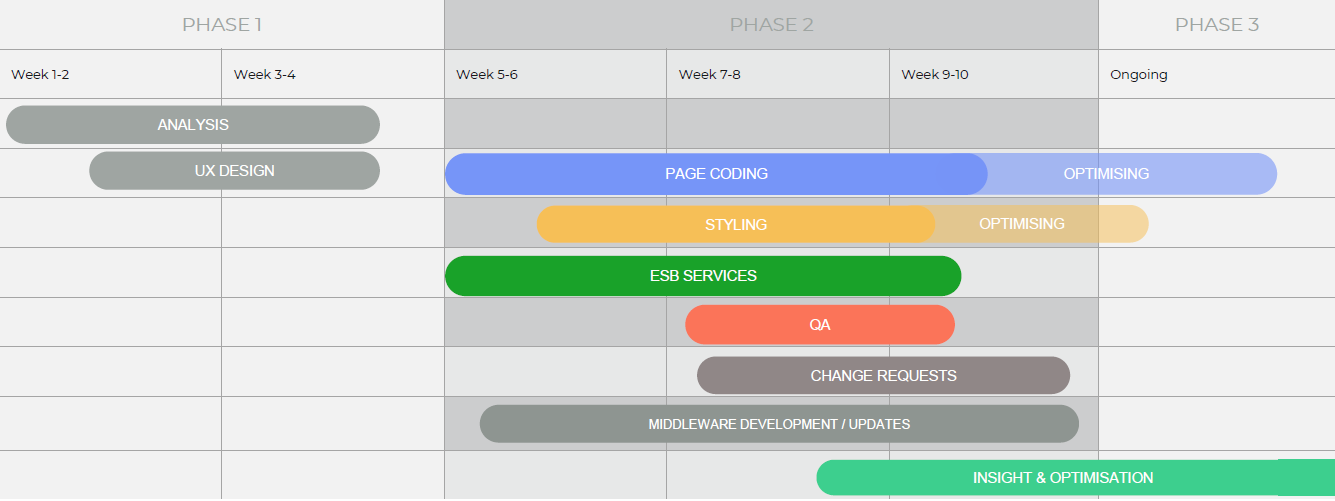

Get a Pilot Solution within 10 Weeks

We’ll prepare an initial analysis within 4 weeks and within 10 weeks we’ll implement a tailor-made pilot solution just for you.

Our onboarding solution is used by millions of end users in the financial sector. Using this app, a foreign financial institution has increased their closing percentage three fold.

A financial institution using our mobile onboarding has increased its conversion 3x.